In a landmark decision, the Indian government has reinstated a pension system named Unified Pension Scheme similar to the Old Pension Scheme (OPS), ensuring financial security for its employees. In this article you will understand what the Unified Pension Scheme (UPS) entails and how it differs from the New Pension Scheme (NPS).

The Evolution of Pension Systems in India

Pensions have always been a crucial component of financial security for government employees in India. The latest development in this ongoing evolution is the introduction of the Unified Pension Scheme (UPS), which promises to provide a more secure and predictable retirement benefit, similar to the Old Pension Scheme (OPS) that was replaced by the New Pension Scheme (NPS) two decades ago.

On August 24, 2024, the Union Cabinet, under the leadership of Prime Minister Narendra Modi, approved the UPS, marking a significant shift in the government’s approach to employee pensions.

Understanding the Unified Pension Scheme (UPS)

What is the Unified Pension Scheme?

The Unified Pension Scheme (UPS) is a newly introduced pension system that assures government employees 50% of their last drawn salary as a lifelong monthly pension. This scheme is designed to provide financial stability to retired government employees, ensuring that they have a guaranteed income post-retirement.

Key Features of the UPS

- Assured Pension: Under the UPS, employees who have completed a minimum of 25 years of service are assured a pension equivalent to 50% of the average basic pay drawn over the last 12 months before retirement. For those with less than 25 years but more than 10 years of service, the pension is proportionate to their service duration.

- Family Pension: In the unfortunate event of an employee’s demise, their family is assured 60% of the pension that the employee was entitled to, ensuring continued financial support for the dependents.

- Minimum Pension: The scheme guarantees a minimum pension of ₹10,000 per month for employees who have completed at least 10 years of service, ensuring that even those with lower pay scales have a basic level of financial security in retirement.

- Inflation Indexation: Pensions under the UPS will be adjusted according to inflation trends, with dearness relief (DR) hikes based on the All India Consumer Price Index for Industrial Workers (AICPI-IW). This ensures that retirees’ purchasing power is protected against rising prices.

- Lump Sum Retirement Payment: In addition to the monthly pension, retirees will receive a lump sum payment at the time of retirement. This amount will be 1/10th of the monthly emoluments (pay + DA) for every completed six months of service, providing an additional financial support upon retirement.

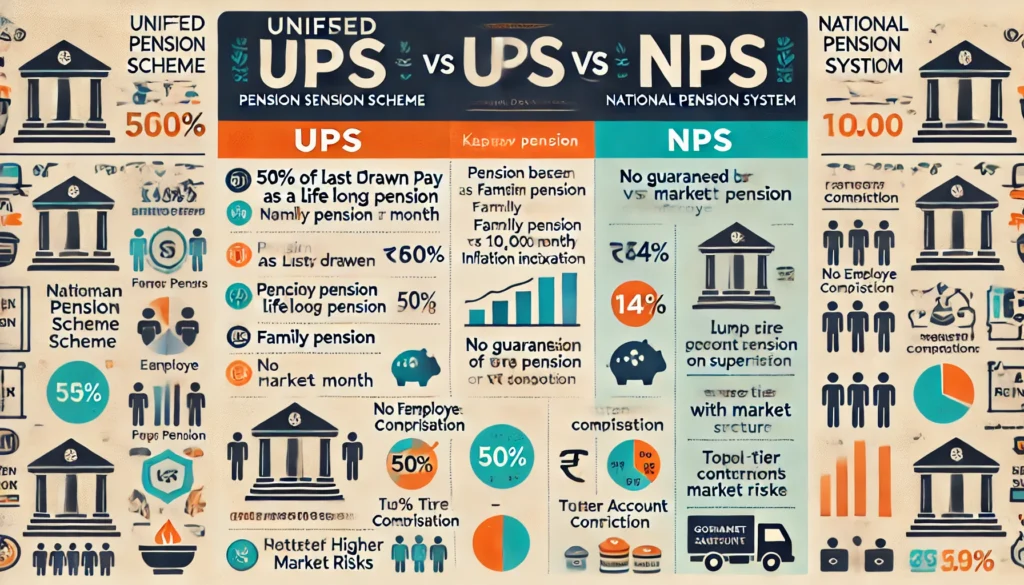

UPS vs. NPS: A Comparative Analysis

The introduction of the Unified Pension Scheme marks a significant departure from the New Pension Scheme (NPS), which was implemented in 2004. To understand the implications of this shift, it is essential to compare the two systems:

1. Guaranteed Benefits vs. Market-Linked Returns

- UPS: The Unified Pension Scheme is a defined benefit pension system, meaning that the pension amount is fixed and guaranteed. Employees can plan their retirement with the assurance of receiving 50% of their last drawn salary as a pension.

- NPS: The New Pension Scheme, on the other hand, is a defined contribution system. The pension amount under NPS depends on the contributions made by the employee and the government, which are then invested in market-linked instruments. The returns and, consequently, the pension amount vary based on market performance.

2. Employee Contributions

- UPS: Under the UPS, there are no mandatory contributions required from employees. The pension is funded entirely by the government, similar to the Old Pension Scheme.

- NPS: The NPS requires employees to contribute 10% of their basic salary towards the pension fund, which is matched by a 14% contribution from the government. These contributions are then invested, and the pension is based on the accumulated amount.

3. Family Pension

- UPS: In the event of an employee’s death, the family is entitled to 60% of the employee’s pension. This ensures that the dependents have continued financial support.

- NPS: Under the NPS, the family pension depends on the accumulated amount and the pension plan chosen at retirement. This could lead to variability in the amount received by the family.

4. Minimum Pension Guarantee

- UPS: The UPS guarantees a minimum pension of ₹10,000 per month for those with at least 10 years of service. This provides a safety net for all retirees, regardless of their pay scale.

- NPS: The NPS does not offer a guaranteed minimum pension. The amount depends entirely on the amount accumulated through contributions and market performance.

5. Inflation Protection

- UPS: The UPS includes inflation indexation through dearness relief (DR) hikes, ensuring that the pension amount keeps pace with rising prices.

- NPS: Pensions under the NPS are not automatically adjusted for inflation. Retirees may need to rely on the returns from their amount to manage inflation.

Here’s a table that clearly outlines the differences between the Unified Pension Scheme (UPS) and the New Pension Scheme (NPS):

| Feature | Unified Pension Scheme (UPS) | New Pension Scheme (NPS) |

| Type of Scheme | Defined Benefit Pension Scheme | Defined Contribution Pension Scheme |

| Pension Calculation | 50% of the average basic pay of the last 12 months before retirement for those with at least 25 years of service; proportionate for lesser service | Based on the accumulated amount from contributions and market performance |

| Employee Contribution | None | 10% of basic salary + DA (Dearness Allowance) |

| Government Contribution | Fully funded by the government | 14% of basic salary + DA |

| Family Pension | 60% of the pension received by the employee | Depends on the accumulated amount and pension plan |

| Minimum Pension Guarantee | ₹10,000 per month for those with at least 10 years of service | No guaranteed minimum pension |

| Inflation Protection | Yes, through periodic Dearness Relief (DR) hikes | No automatic inflation protection; depends on returns |

| Lump Sum Payment at Retirement | 1/10th of monthly emoluments (pay + DA) for every completed six months of service, in addition to gratuity | Depends on the withdrawal options chosen |

| Pension Payout Basis | Fixed and guaranteed, based on last drawn salary | Variable, based on market returns |

| Risk Exposure | No market risk, guaranteed pension | Exposed to market risks, pension amount may fluctuate |

| Applicability | Primarily for central government employees with long service tenures | Applies to government employees who joined after January 1, 2004 |

| Inflation Indexation | Yes, through Dearness Relief (DR) | Not included |

Benefits of the Unified Pension Scheme

The introduction of the UPS brings several benefits to government employees, particularly those who are nearing retirement or have served long tenures. Here are some of the key advantages:

1. Financial Security

The UPS provides a guaranteed pension amount, offering financial stability and predictability in retirement. Employees can plan their post-retirement life without worrying about market fluctuations.

2. Protection Against Inflation

With inflation indexation built into the scheme, retirees’ pensions will be adjusted to reflect changes in the cost of living. This ensures that their purchasing power remains intact over the years.

3. No Mandatory Contributions

Unlike the NPS, the UPS does not require employees to contribute a portion of their salary towards the pension fund. This allows them to allocate their earnings towards other financial goals during their working years.

4. Enhanced Family Support

In the event of an employee’s death, the family receives 60% of the pension amount, ensuring that dependents are financially supported.

5. Minimum Pension Guarantee

The ₹10,000 minimum pension guarantee provides a safety net for lower-paid employees, ensuring that they have sufficient income in retirement.

What Does the UPS Mean for Central Government Employees?

The Unified Pension Scheme is set to take effect on April 1, 2025, with its benefits applicable to those who retire by March 31, 2025. This includes the payment of any arrears. The scheme primarily targets employees who have served longer tenures, offering them a stable and predictable retirement income.

For central government employees, the UPS represents a return to a more traditional pension system, one that prioritizes financial security over potential market-driven returns. While the NPS offers the possibility of higher returns, it comes with greater risk. The UPS, on the other hand, provides peace of mind with its guaranteed benefits and protection against inflation.

Implications for Fiscal Policy

While the UPS is undoubtedly beneficial for government employees, it also has significant implications for the government’s fiscal policy. The shift from a market-linked pension system to a defined benefit system could increase the government’s financial obligations. However, the Cabinet’s decision was informed by the recommendations of a committee led by former Finance Secretary and Cabinet Secretary-designate T.V. Somanathan, which sought to balance employee aspirations with fiscal prudence.

A Return to Stability

The introduction of the Unified Pension Scheme signals a return to stability for government employees. After two decades of the NPS, which linked pensions to market performance, the UPS brings back the predictability and security that many employees have desired for. By ensuring a guaranteed pension amount, inflation protection, and support for dependents, the UPS aims to provide a more comprehensive and reliable retirement benefit for central government employees.

A Bold Step Towards Employee Welfare

The Unified Pension Scheme is a bold and significant step by the Indian government towards enhancing the welfare of its employees. By reintroducing a system that offers guaranteed benefits and financial security, the government has responded to the long-standing demands of its workforce. The UPS not only ensures a stable retirement income but also provides a safety net for families, making it a comprehensive and employee-friendly pension system.

As the scheme is set to roll out in 2025, it remains to be seen how it will impact the broader financial landscape and the government’s fiscal health. However, for the millions of central government employees, the UPS represents a welcome return to stability and security in their retirement years.

FAQs:

Is the UPS Scheme for Private Employees?

The Unified Pension Scheme (UPS) is specifically designed for government employees, not for those in the private sector. It guarantees a pension that equals 50% of the average basic salary from the last 12 months of service.

Source: PIB

Read Article: Justin Bieber Welcomes Baby Boy: The Beginning of a New Chapter

Read Article: Google Pixel 9 Pro: Google’s Latest Smartphone Experience